Dalton Corporation has been acquired by an undisclosed strategic buyer.

Birmingham, Michigan – January 29, 2024 – Angle Advisors is pleased to announce that Dalton Corporation (“Dalton”), a portfolio company of Speyside Equity with operations in Warsaw, Indiana and Stryker, Ohio, has been sold to an undisclosed strategic buyer. Angle Advisors acted as the exclusive investment banking advisor to Dalton and Speyside Equity in completing this transaction.

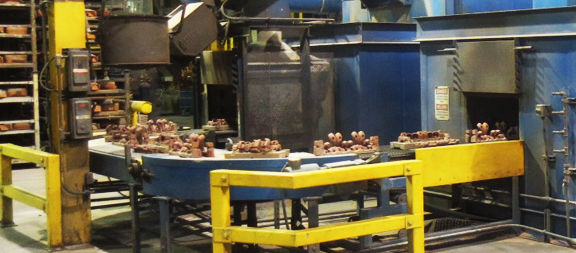

Founded in 1914, Dalton Corporation is a premium supplier of gray iron, compacted graphite iron, and ductile iron castings. Dalton provides large, highly-cored, and complex iron castings for the agriculture, railroad, construction, medium/heavy-duty truck, defense, air conditioning/refrigeration, automotive performance aftermarket, power transmission, and material handling sectors. Dalton’s automated molding lines are designed to accommodate iron castings ranging in size from 20 to 1,400 pounds. Through continued investment in the latest process technologies and production equipment, the Company’s modern infrastructure is highlighted by an integrated pattern shop, an extensive internal core making operation, annual melt capacity of nearly 100,000 tons, and automated, green sand molding lines with mold sizes up to 40” x 48” x 16”. In addition to internal production of complex cores and core assemblies (up to 16 cores per castings), Dalton’s value-added services include shot blasting, robotic deburring, rough machining, final machining, and assembly. Led by a proven management team and a highly skilled workforce of approximately 300 employees, Dalton operates a foundry in Warsaw, Indiana with 345,000ft2 of production, engineering, and administrative facilities and a 53,000ft2 machining plant in Stryker, Ohio. For additional information, please visit www.daltoncorporation.com.

Speyside Equity Fund I LP is a $130M special situations fund focusing on opportunities to deploy resources to generate a step change in operating performance. Since 2016, the fund has made 21 investments totaling over $1B in revenue, with 1,720 employees operating in 14 countries.

Angle Advisors, with offices in the United States, Germany, and China, specializes in mergers and acquisitions and capital raising. The firm’s professionals have completed 294 transactions since 2009 for multinational corporations, privately held companies, private equity funds, and public sector clients. For additional information, please visit www.angleadvisors.com.